Two major shipping giants announced that Asia-Europe routes from November against the trend of price increases: short-term momentum? Stable long-term price?

Shipping spot market rates have fallen continuously, but some shipping companies have bucked the trend of price increases on the Asia-Europe line.

Recently, two well-known shipping companies, CMA CGM and Hapag-Lloyd, announced plans to increase freight rates on Asia-Europe routes from November 1. Specifically, CMA CGM adjusts the FAK rate (flat rate, that is, all cargo is charged a uniform rate) for all shipments from Asian ports to Northern European ports, which is specifically $1,000 /TEU (container length of 20 feet) and $1,800 /FEU (container length of 40 feet).

Previously, CMA CGM had raised the freight rate for Asia-Europe routes on August 15, when it was raised to $1,150 /TEU and $2,100 /FEU (including dry boxes and refrigerated boxes).

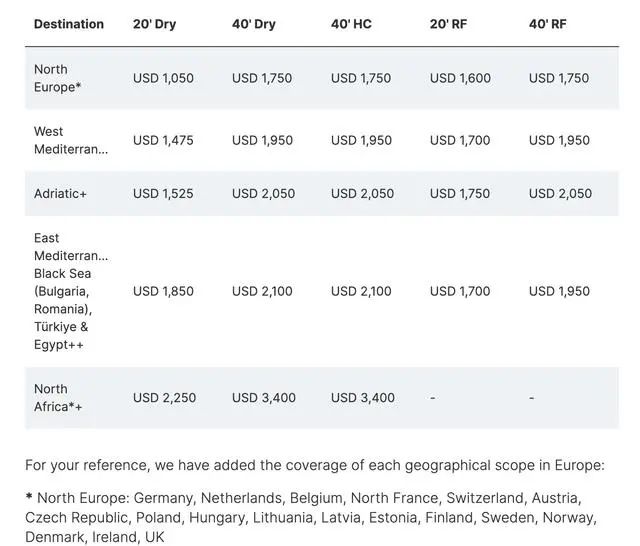

Hapag-lloyd, for its part, plans to raise FAK for all types of cargo from the Far East to Northern Europe and the Mediterranean. Among them, the dry container freight from the Far East to Northern Europe is 1050 US dollars /TEU, 1750 US dollars /FEU; Reefers are charged $1,600 /TEU and $1,750 /FEU.

Hapag-lloyd official route price adjustment information

"The container liner market peaked in 2021. "Looking ahead to next year, container volumes are likely to return to 2021 levels, with current rates falling but not yet bottoming out, and rates will not reach their 2021 peak."

On October 12, the 2023 China Marine Equipment Expo, sponsored by China State Shipbuilding Group Co., LTD., opened in Fuzhou. At the "2023 Shipping Logistics Development Forum" held during the period, Zhao Yifei, associate professor of Antai School of Economics and Management of Shanghai Jiao Tong University and head of the shipping industry team of the Industry Research Institute, made the above statement when sharing a speech.

Behind the price increase of some shipowners on the Asia-Europe route: short-term behavior, limited increase, and stable long-term cooperation price

"Liner companies plan to raise prices on the spot market, but also need to look at the quantity of goods, and the amount of goods on the European line is obviously not much." A person in charge of a Shanghai freight forwarding company told the surging news reporter on October 13 that the freight rate of the Asia-Europe line is not high at this time of year near the holiday, and the goods to Europe this year are less than last year. In July and August this year, freight rates fell by about 30% compared with the same period last year.

"The European line is almost empty. The freight rate is usually proportional to the volume of cargo, and the European line has dropped 20 to 30 percent since the beginning of this year. Another Shanghai freight forwarder told the surging news reporter that the small container of Ouji Port is currently $500 and the large high container is $900.

The freight forwarder also said that the shipping company has also pushed up the freight rate, but there is no cargo, and it can not rise and fall back. In November, some shipping companies plan to push up again, and it is estimated that it may not really rise. Another freight forwarder told surging news reporters that the price increase is also bullish, rising $20 to $50 a cabinet is not up.

According to the global shipping market dynamics released by Kuehne & Nagel, one of the world's largest freight forwarding companies, on October 12, the trend of freight rates from China to Europe from mid-October to late October showed obvious signs of weakness in booking, and the SCFI (Shanghai Export Container Freight Index) European line index continued to decline before the holiday, affected by the Golden Week holiday, the market freight rate is expected to fluctuate less. Most shipping companies keep their rates until the end of October. In response to the gloomy market and continued low freight rates, some shipping companies have announced an increase in European base port prices from November 1, while others are currently on the sidelines.

Previously, some shipping giants said when looking ahead to the second half of this year that they saw the opportunities brought by the rebound in freight rates of the main routes in Europe and the United States and the new environmental regulations to promote the clearance of old ships.

On October 12, a regional executive of a container transportation company under a central enterprise group told surging news reporters that some shipping companies raised the freight rate of Asia-Europe routes is a short-term behavior of the market. With the arrival of Christmas and Spring Festival, it will usher in the peak season of the shipping market, when the overall freight rate will show a significant change.

The above executives also said that the market as a whole is not prosperous this year, due to the serious decline in freight prices in the early stage, although there are sometimes moves to raise prices, it is still unable to change the overall oversupply situation, so the rate of increase is still limited.

"As the current trade demand is not high overall, liner companies announced freight rate increases, more for 'publicity'." Zhao Yifei said that shipping prices are usually divided into long-term cooperation and spot market prices, which account for different proportions in each liner company, and the overall show a 50-50 split. At present, the rise is mainly the part of the market price, "has been unable to fall, liner companies may be creating space for future freight price decline."

"At present, the price increases of liner companies are very scattered, some increase basic freight rates, and some increase different surcharges, indicating that the market has not formed a real price increase mechanism, and each liner company is trying to whether the so-called price increase can be accepted by the market, but also reflects the personalized exploration of different liner companies." Zhao Yifei stressed.

Zhao Yifei further said that in the past year, the freight rate of the liner market has gradually returned to normal, and each carrier has a short-term price increase on the spot market in the decline of freight rates. Some of the price increases are different, some are basic freight rates, some are surcharges, and some are only prices on a certain route, unlike the concentrated increase in basic freight rates when the market is hot in 2020.

"In regular years, October is the time for major shipowners and shipowners to sign long agreements, and usually the major European shipowners and mainstream liner companies sign long agreements, and some leading liner companies account for about 60% of the volume of long agreements." Ma Hui, deputy editor of the shipping industry network, told the surging news reporter that the negotiated price is related to the "tacit understanding" and "loyalty" between the liner company and the cargo owner, and for customers who have a large number of fixed shipping needs every month, the negotiated price and the stability and durability of the shipping space provided by the liner company, especially the reliability of the service are very important links.

Ma Hui further said that when the market spot rate of a specific route market is a "floor price" or much lower than the price of the long Association, the situation of tearing up the long Association also happens. For shippers with unstable shipments and smaller volumes, the long-term price is generally more limited. The subtle thing is that the news of the floating adjustment of the current spot market rate is more like a catalyst for the two sides of the "game" at the negotiating table.

On September 6 last year, Chen Shuai, deputy general manager of COSCO Sea Control (601919.SH), also said at the semi-annual performance presentation that the company currently has more than half of the long-haul cargo in the direction of European and American trunk exports. The company has confidence in the performance ability of its core contract customers. Although the current market volume due to high inventory and other factors have fluctuated, but so far most customers still adhere to the attitude of the contract. If new changes occur in the subsequent market, the company will properly handle the contract between the two parties after comprehensively evaluating the customer's previous performance and other factors, but it is believed that there will be no breach of the contract and the overall impact will be limited. Therefore, the contract goods will continue to become an important guarantee for the company to provide stable and reliable services to customers in an uncertain environment and improve its own business resilience.

2023-10-16来源:https://mp.weixin.qq.com/s/se6Gp553TTxJYTmgJUpXUw

Recent news

Hainan Yangpu Port: Step up the channel reconstruction and expansion to meet the navigation of 200,000-ton container ships

Boat, boat, boat! More than 60 new ships are under construction in Shanghai's three big Ships

Will the US impose 60% tariffs on all Chinese goods? Response of the Ministry of Foreign Affairs

Maersk set up an international transshipment center in Lingang, Shanghai

"Sea Hercules" and new Chinese ships Hudong China opened a new beginning of the New Year ship delivery

More than 500 ships! Ningde time on board

Swim upstream! Chinese shipping company to carry out Red Sea express