Sea freight is more than three times the price of last year! The risk of tariffs is driving international traders to scramble for shipping capacity

Neither the busy Lunar New Year in Asia, nor the important Black Five and Christmas in Europe and the United States, the international shipping market suddenly ushered in a surge in freight prices in June, which should have been flat.

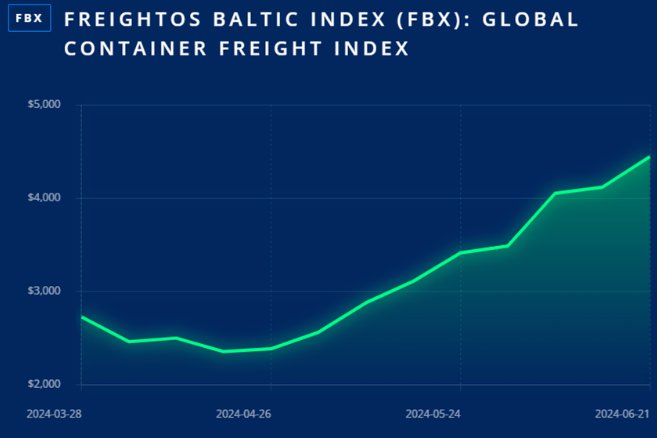

According to the FBX index of container spot prices for major shipping lines compiled by shipping platform Freightos, international shipping freight rates have risen from about $1,200 per trip in 2023 to nearly $4,500 today, nearly 30% higher than the peak of $3,400 triggered by Red Sea artillery in January.

According to AXSMarine analyst Jan Tiedemann, shipping capacity has been increasing this year. In 2023, new container ships delivered added capacity of 2 million 20-foot equivalent containers, a record. The seaborne market is expected to add 3 million TEU of capacity this year and another 2 million TEU in 2025.

The industry believes that the factors driving the abnormal rise in ocean freight are very complex. One is that global manufacturing is recovering, particularly in Germany, where the S&P purchasing managers' index grew at its fastest year-on-year pace in 22 months in May. Coupled with strikes at major German ports, this has left many exporters scrambling to find sufficient capacity.

On the other hand, the rise of protectionism has led many exporters to speed up the pace of delivery of goods to avoid being affected by tariffs and other policies.

As the US government announced a significant increase in tariffs on some Chinese goods, Industrial Bank Research analysts pointed out that some traders are competing for shipping capacity, and some tariff measures are expected to take effect as early as August. On the other hand, the European Union is also negotiating with China on electric vehicle tariffs, further aggravating the concerns of international traders.

As the world's three largest economies, the trade trends of China, the United States and the European Union are undoubtedly the key influencing factors for international trade, coupled with the election year in Europe and the United States this year, the rise of the far-right forces in Europe and Trump's return to the White House, more than cast a shadow on the global supply chain.

In addition to these factors, tensions in the Red Sea itself are increasing the cost of shipping. In particular, cargo from Europe and Asia via the Mediterranean now takes an extra two weeks to complete its journey around the Cape of Good Hope, meaning traders need to put in more ships to balance the flow.

According to AXSMarine, new vessels with a total capacity of 1 million TEUs have come into service this year, but the proportion of idle fleet has fallen to 0.6 per cent. That's the lowest level since February 2022 and well below the 3 percent that is considered healthy.

Freightos estimates that rates could rise as high as $9,000 on some routes in the coming months. Although the negative effects of the tariff wave and port strikes will gradually fade later, the Red Sea crisis is still severe, which means that the high cost of international freight is difficult to see a solution in the short term.

2024-06-27来源:航运在线

Recent news

Hainan Yangpu Port: Step up the channel reconstruction and expansion to meet the navigation of 200,000-ton container ships

Boat, boat, boat! More than 60 new ships are under construction in Shanghai's three big Ships

Will the US impose 60% tariffs on all Chinese goods? Response of the Ministry of Foreign Affairs

Maersk set up an international transshipment center in Lingang, Shanghai

"Sea Hercules" and new Chinese ships Hudong China opened a new beginning of the New Year ship delivery

More than 500 ships! Ningde time on board

Swim upstream! Chinese shipping company to carry out Red Sea express