Shipping giants such as Maersk are spending billions of dollars to build carriers

Some shipping giants are pouring billions of dollars into ammonia-fueled ships, betting that ammonia will become an integral part of the decarbonization of the shipping industry.

Companies including Maersk, two Greek shipping giants and two top Japanese shipping lines have ordered a total of $16 billion worth of vessels, many of which will be able to transport ammonia, according to research firm VesselsValue.

Ammonia, which is formed by combining nitrogen and hydrogen, is seen as key to helping the shipping industry wean itself off fossil fuels, especially the cleanest ammonia, which has lower carbon emissions. Thanks to booming U.S. exports and surging demand from China, the fleet has grown rapidly in the past few years. Today, these fleets mainly transport liquefied gas and petrochemicals, which are used for heating. The addition of low-carbon ammonia could create a new source of goods by 2027.

"The next stage is the ammonia story," said BW LPG Ltd, owner of the world's largest very large natural gas carrier. Chief Executive Kristian Sorensen said. "This is the story that people face when they build ships now. Whether it's this decade or the next remains to be seen."

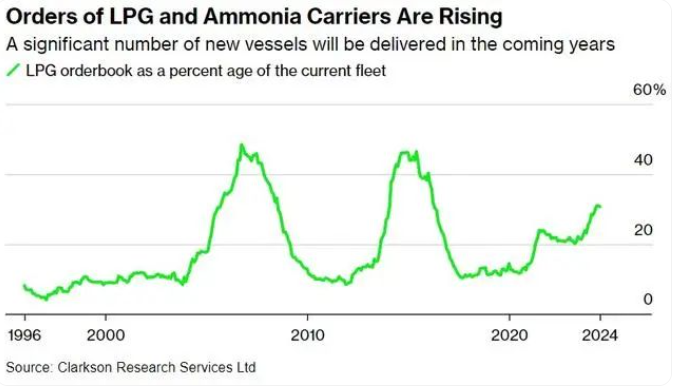

Orders for liquefied petroleum gas and ammonia carriers rose

Ammonia production remains uncertain

The need for low-carbon, clean ammonia as a shipping fuel has become more urgent this year as Houthi attacks in the Red Sea have caused merchant fleets to circumnavigate Africa, rapidly pushing up the industry's already huge emissions.

There are two environmentally friendly ways to make this fuel, depending largely on how the hydrogen is produced. Green ammonia, the greenest, uses hydrogen from renewable energy sources, while blue ammonia relies on natural gas and carbon capture. Both require a lot of energy.

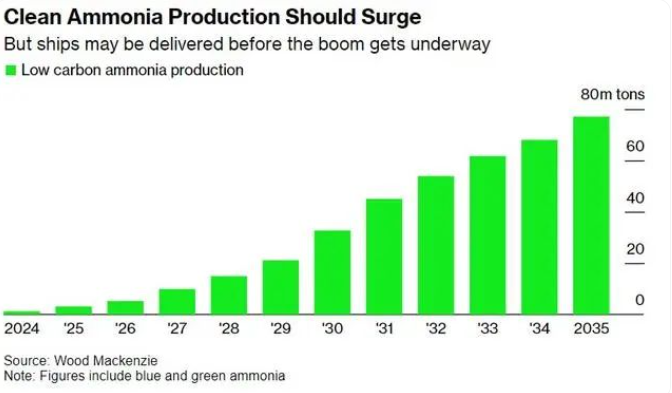

Despite the expense - most of the new ships will join the fleet within two to three years - it is unclear whether there will be an adequate supply of low-carbon ammonia when they take to the water.

Wood Mackenzie, a consultancy, predicts that production of green and blue ammonia will reach 9.9 million tonnes by 2027. That equates to about 200,000 barrels a day, or 0.2 percent of current global oil demand. This is also equivalent to about 7% of current LPG fleet demand.

Clean ammonia production is expected to surge

According to IEA estimates of ammonia production for shipping and power generation, nearly two-thirds of announced projects are in very early stages of development, with some not even starting feasibility studies. This means that there is a lot of uncertainty about whether the production forecast will be realized.

If difficulties are encountered in producing clean ammonia, it may not be a disaster for shipping companies. Increased U.S. fuel export capacity and increased demand for cooking gas also had an impact on orders.

Bilateral trade between the two countries has boomed over the past decade as US hydrocarbon exports have surged and China's petrochemical capacity has soared, with the market for very large liquefied petroleum gas carriers (VLGC) booming.

Meanwhile, the International Energy Agency says LPG will become the main way hundreds of millions of people around the world cook with cleaner fuels by the end of the decade.

As a result, large new ship orders are second only to container ships and liquefied natural gas carriers as a percentage of the existing fleet.

Which big companies have entered?

Companies with orders for ammonia carriers include TMS Cardiff Gas Ltd. And Capital Maritime, owned by Greek investors George Economou and Evangelos Marinakis, respectively. Japanese shipping giants Mitsui and NYK also have orders for delivery in 2026 and beyond, Clarkson's data shows.

Maersk, a shipping company for petroleum products and chemicals, has ordered 10 such vessels. That would make it a significant player in emerging markets.

Commodities trader Trafigura has ordered a number of smaller ammonia carriers, while rival Gunvor Group has ordered four very large liquefied gas vessels to transport liquefied petroleum gas.

But for the freight market to expand and the shipping industry to start reducing emissions, the trade in clean ammonia must take off.

Jonathan Fancher, chief executive of Petredec, an LPG trading company, said: "The fleet that has developed today has been absorbed with ease." "Future orders, while reflecting known and healthy LPG production growth and export expansion, do depend to some extent on ammonia trade."

2024-07-17来源:航运在线

Recent news

Hainan Yangpu Port: Step up the channel reconstruction and expansion to meet the navigation of 200,000-ton container ships

Boat, boat, boat! More than 60 new ships are under construction in Shanghai's three big Ships

Will the US impose 60% tariffs on all Chinese goods? Response of the Ministry of Foreign Affairs

Maersk set up an international transshipment center in Lingang, Shanghai

"Sea Hercules" and new Chinese ships Hudong China opened a new beginning of the New Year ship delivery

More than 500 ships! Ningde time on board

Swim upstream! Chinese shipping company to carry out Red Sea express