"Five-figure" container freight rate is about to return? American importers are in a hurry...

The cost of shipping a 40-foot container of toys, auto parts or other goods from Shanghai to New York has now jumped to nearly $10,000, adding to frustration among American importers and prompting some experts to say the shipping market is in a bubble.

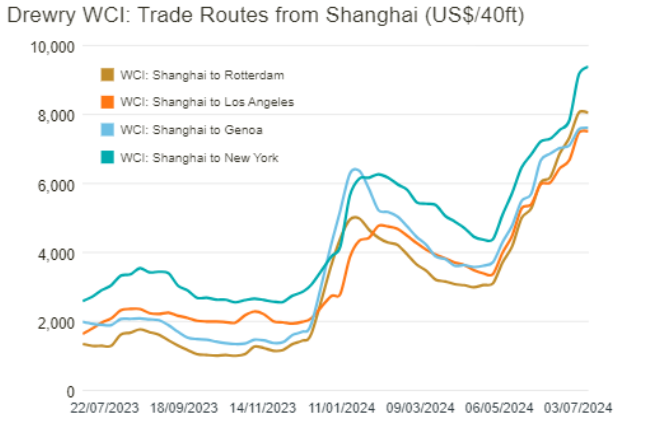

The Drury World Container Index shows that as of Thursday (July 11), spot freight prices for a 40-foot container on the Shanghai-New York route had reached $9,387.

While that is still down from an early peak of about $16,000, which was driven up by a shopping spree by consumers locked out of their homes because of the pandemic, it is more than double what it was in February.

In addition to the most distant routes mentioned above, the closely watched container freight rate index from Shanghai to the West Coast of the United States (Los Angeles) also exceeded $8,100 this month. The Drury index shows that freight rates on the trade route are now about 60 per cent of the $12,400 per 40-foot container at the peak of the pandemic.

Industry experts believe that the main reason for the increase in shipping prices is still Houthi missile and drone attacks in Yemen, forcing a large number of ships to avoid the Suez Canal trade shortcut. Alternative routes around Africa take longer, so fleets also need longer voyages and more ships to transport goods.

This has led to a shortage of ships, disruption and delays to cargo schedules and has pushed up the cost of maritime transport, which accounts for about 80 per cent of international trade.

Some US retailers and other shippers have responded by bringing forward imports - stocking up ahead of the busy "peak" season for imports of goods such as students going back to school, Halloween and Christmas - but the surge in demand over a short period of time has also contributed to higher ocean freight rates.

The direction of shipping rates is confusing

Some U.S. importers who remember the last bout of inflation that sent shipping costs soaring are now worried about more increases ahead.

Greg Davidson, CEO of Lalo, said there has never been transparency about what actually drives shipping prices, only assumptions. The company sells stylish baby high chairs online and in Pottery Barn Kids stores.

"Container rates are priced like a black box, and shippers large and small in his industry network are now preparing for rates to go up to $20,000," he said.

Davidson explained that this was partly due to concerns that if Republican presidential candidate Donald Trump wins the U.S. election in November, the former president could impose sweeping tariffs on imports. Importers often rush goods ahead of tariffs, causing freight rates to soar.

Large shipping giants such as Maersk and Hapag-Lloyd have recently raised their profit forecasts as strong demand and higher freight rates support their results.

However, some professionals also say that behind the current high shipping prices, there may already be a bubble. "It's a bubble that will burst," says Simon Heaney, senior manager of container research at Drury, referring to container rates.

Heaney said clients surveyed by the consulting firm expect prices to fall in the first half of next year.

Deutsche Bank Research analyst Andy Chu said in a note to clients, "It is difficult to understand the magnitude and speed of freight rate increases." The pullback in new orders from manufacturing business customers in May, which has historically been closely correlated with container demand, should have broken the trend and lower demand could have pulled prices down quickly."

"If demand is not sustained, then freight rates could normalize quickly," he noted.

2024-07-18来源:航运在线

Recent news

Hainan Yangpu Port: Step up the channel reconstruction and expansion to meet the navigation of 200,000-ton container ships

Boat, boat, boat! More than 60 new ships are under construction in Shanghai's three big Ships

Will the US impose 60% tariffs on all Chinese goods? Response of the Ministry of Foreign Affairs

Maersk set up an international transshipment center in Lingang, Shanghai

"Sea Hercules" and new Chinese ships Hudong China opened a new beginning of the New Year ship delivery

More than 500 ships! Ningde time on board

Swim upstream! Chinese shipping company to carry out Red Sea express