Rates fall! Four major routes down!

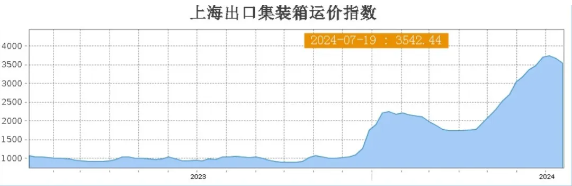

The previous rising sea freight in the container market, after ushering in an inflection point in mid-July, began to show an overall correction.

On July 19, the latest Shanghai export container comprehensive freight index was 3542.44 points, down 3.6% from the previous period. The four major ocean-going routes in Europe and the United States all suffered declines of more than 1%.

Among them, the spot market booking prices for European routes fell slightly. On July 19, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the European basic port market was US $5,000 /TEU, down 1.0% from the previous period. Rates on the Mediterranean route were largely in line with those on the European route, with the market rate falling slightly to $5,361 /TEU, down 1.2%.

The supply and demand relationship between North American routes has weakened, and market freight rates continue to adjust. On July 19, the market freight rate (sea freight and sea surcharge) for exports from the Port of Shanghai to the West of the United States was US $7124 /FEU, down 6.9% from the previous period. The freight rate (sea freight and sea surcharge) for exports from Shanghai port to the US East Base port market was US $9,751 /FEU, down 1.3%.

According to industry insiders, the main factor affecting the freight rate correction is the increase in capacity. Since early July, new capacity has been added to the American Line. The addition of overtime ships and new shipping companies has gradually reduced the freight rate of the United States line. Affected by this, it is expected that in late July, the freight rate of the United States line will continue to fall.

High freight rates in Europe and the United States have attracted a large number of overtime vessels into the market, and the launch of new route services to compete for cargo sources, and the increasing supply of capacity has had a significant impact on the performance of freight rates in the past two weeks.

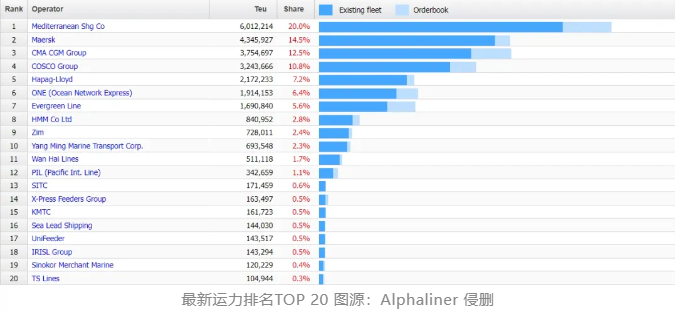

Alphaliner's latest data shows that as of July 19, 2024, the number of container ships in operation worldwide totaled 7,022 with a total capacity of approximately 30.266 million TEU.

The top three shipping capacity are MSC, Maersk Line and CMA CGM ships, of which MSC has more than 6 million TEU of existing capacity, while occupying 20% of the market share.

Shipping companies ranked 4th to 10th in terms of capacity are: COSCO Shipping, Hapag-Lloyd, ONE, Evergreen Shipping, HMM (Hanshin Shipping), Star Shipping and Yangming Shipping.

Although July to August is the traditional shipping season every year, the peak season this year is overall ahead of schedule, resulting in August - September it is difficult to see a new wave of shipments. However, there are also views that even if there is a correction after the current peak of sea freight, the correction is expected to be limited.

2024-07-24来源:航运在线

Recent news

Hainan Yangpu Port: Step up the channel reconstruction and expansion to meet the navigation of 200,000-ton container ships

Boat, boat, boat! More than 60 new ships are under construction in Shanghai's three big Ships

Will the US impose 60% tariffs on all Chinese goods? Response of the Ministry of Foreign Affairs

Maersk set up an international transshipment center in Lingang, Shanghai

"Sea Hercules" and new Chinese ships Hudong China opened a new beginning of the New Year ship delivery

More than 500 ships! Ningde time on board

Swim upstream! Chinese shipping company to carry out Red Sea express