Oversupply and Red Sea shipping disruptions ease... Fitch: Container shipping will be under pressure next year

According to Taiwan media reports, international credit rating agency Fitch Ratings recently forecast that the tanker and dry bulk shipping market performance is expected to remain solid in 2025, thanks to high demand, and is expected to achieve above-average profits. But next year, global container shipping is likely to face pressure from oversupply and easing disruptions in the Red Sea.

Fitch expects tanker and dry bulk demand to grow in 2025, but at a slower pace than in 2024. Dry bulk shipments are forecast to grow by about 1 percent in 2025, down from 2.7 percent in 2024, mainly due to declining global demand for iron ore and coal and rising trade tensions, but grain exports will provide some momentum.

Fitch expects tanker and dry bulk freight rates to be roughly flat in 2025 after a slight improvement in 2024.

According to the International Energy Agency (IEA), oil demand will increase by 1 million barrels per day in 2025, most of which will be supplied by countries outside the OPEC+ oil producers' alliance. Higher Russian oil exports will also support overall demand. Easing geopolitical tensions and improved supply disruptions in the Red Sea could weigh on demand growth.

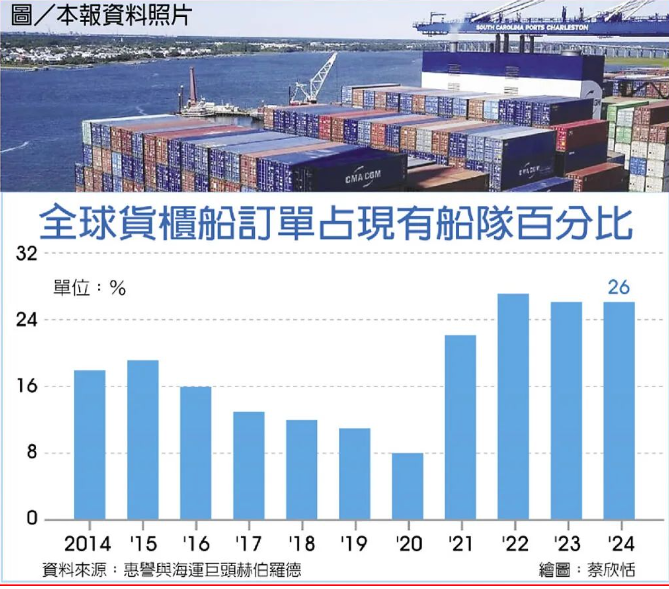

As for container ships, Fitch expects container traffic to grow by 3 percent in 2025, but supply growth of about 5 percent will outpace demand. Despite the delivery of new ships, container ship orders in 2024 will still account for 26% of the current fleet. This reflects a continued influx of new orders to replace older vessels and upgrade fleets in an attempt to meet carbon reduction targets with a variety of fuels.

Fitch said that as more and more new ships are delivered in 2025, container ships may enter a supply glut, which is likely to continue to depress freight rates.

The shipping industry is one of the most vulnerable to geopolitical conflicts due to problems on several key trade routes, its pivotal role in global supply chains and its inability to effectively adjust capacity constraints in the short term. Fitch said that, as previously highlighted in their Global Shipping Outlook 2025 report, average sailing speeds increased in 2024 amid the ongoing disruption of the Red Sea crisis, so there is some room for a decline in 2025 to absorb capacity.

Fitch said earlier this month that changes in trade policy, particularly the outcome of the 2024 U.S. presidential election, could become a significant risk in 2025, leading to a decline in demand for shipping companies. But customer "contingency" supply chain planning can still lead to short-term demand surges.

声明:转载此文是出于传递更多信息之目的。若有来源标注错误或侵犯了您的合法权益,请作者持权属证明与本网联系,我们将及时更正、删除,谢谢。

2024-12-25来源:工商时报

Recent news

Hainan Yangpu Port: Step up the channel reconstruction and expansion to meet the navigation of 200,000-ton container ships

Boat, boat, boat! More than 60 new ships are under construction in Shanghai's three big Ships

Will the US impose 60% tariffs on all Chinese goods? Response of the Ministry of Foreign Affairs

Maersk set up an international transshipment center in Lingang, Shanghai

"Sea Hercules" and new Chinese ships Hudong China opened a new beginning of the New Year ship delivery

More than 500 ships! Ningde time on board

Swim upstream! Chinese shipping company to carry out Red Sea express